Are you planning to buy a new car but don’t have enough funds to make the purchase upfront? Car loans can be an

excellent solution to finance your dream car. When it comes to car loans, two primary options are secured car loans and unsecured car loans.

In this blog post, we will compare these two types of car loans, highlighting their differences and helping you make an informed decision. So, let’s dive in and explore the world of secured and unsecured car loans.

- Identifying the Types of Car Loans

- Understanding Secured Car Loans

- Exploring Unsecured Car Loans

- Key Differences between Secured vs Unsecured Car Loans

- Factors to Consider When Choosing between Secured and Unsecured Car Loans

- Pros and Cons of Secured Car Loans

- Pros and Cons of Unsecured Car Loans

- How to Apply for a Secured Car Loan

- How to Apply for an Unsecured Car Loan

- Tips for Choosing the Right Car Loan

- Conclusion

Identifying the Types of Car Loans

When it comes to purchasing a car, most people rely on car loans to ease the financial burden. Secured and unsecured car loans are the two primary options available to borrowers. Understanding the differences between these types of loans is crucial to ensure you make an informed decision that aligns with your financial situation.

Understanding Secured Car Loans

A secured car loan is a type of loan that requires collateral, typically the car you are purchasing. The lender holds the right to repossess the vehicle if you fail to make timely loan payments. Secured car loans generally offer lower interest rates since they involve less risk for the lender. The collateral provides security, giving the lender a way to recoup the loan amount if the borrower defaults.

Exploring Unsecured Car Loans

Unlike secured car loans, unsecured car loans do not require collateral. These loans are granted based on the borrower’s creditworthiness, income stability, and financial history. Since there is no collateral involved, unsecured car loans pose a higher risk to the lender. As a result, they often come with higher interest rates compared to secured loans.

Key Differences between Secured vs Unsecured Car Loans

Secured and unsecured car loans are two distinct financing options with notable differences. Here are the key contrasts between the two:

- Collateral: Secured car loans require collateral, whereas unsecured car loans do not.

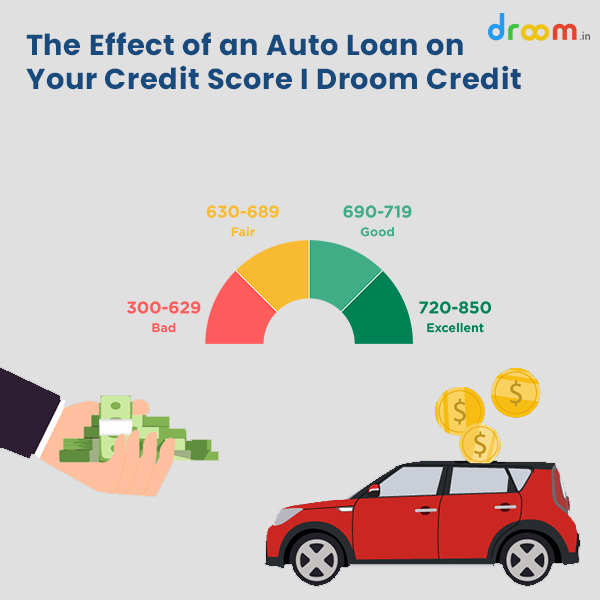

- Interest Rates: Secured car loans typically have lower interest rates, while unsecured car loans have higher interest rates.

- Eligibility Criteria: Secured car loans are relatively easier to obtain as they are backed by collateral, while unsecured car loans require a stronger credit profile.

- Loan Amount: Secured car loans usually offer higher loan amounts compared to unsecured car loans.

- Repossession Risk: In secured car loans, the lender has the right to repossess the vehicle if the borrower defaults on payments. Unsecured car loans do not involve the risk of repossession.

Factors to Consider When Choosing between Secured and Unsecured Car Loans

When deciding between secured and unsecured car loans, there are several important factors to consider. Here are some key factors to help you make an informed decision:

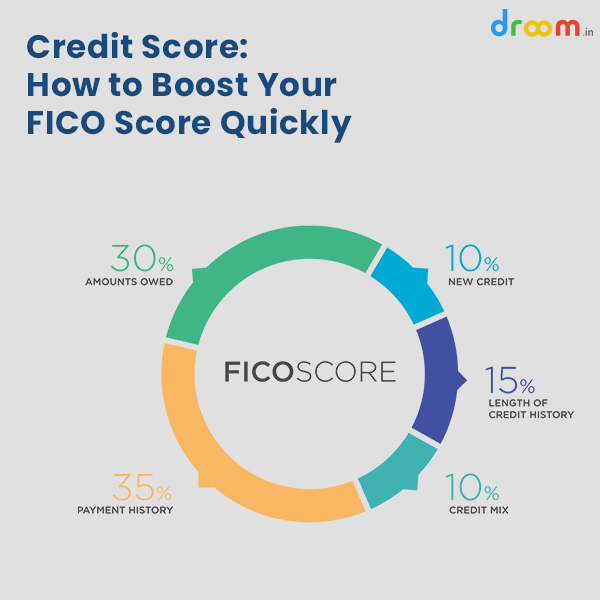

- Credit History: If you have a strong credit history, you may qualify for favorable terms on an unsecured car loan. However, if your credit history is less than ideal, a secured car loan might be a better option.

- Collateral Availability: If you have valuable collateral, such as a property or another vehicle, you may opt for a secured car loan to leverage your assets.

- Interest Rates: Compare the interest rates offered by lenders for both types of loans. Consider your financial situation and choose the loan that offers the most favorable interest rate.

- Loan Amount: Evaluate the total amount you need to borrow and check if it falls within the limits of secured and unsecured car loans.

Pros and Cons of Secured Car Loans

When analyzing the pros and cons of car loans, it is important to thoroughly evaluate the different aspects to make an informed decision. It aims to provide objective information to assist individuals in understanding the advantages and disadvantages of different car loans.

Pros of Secured Car Loan

● Lower interest rates

● Higher loan amounts

● Easier to qualify for

Cons of Secured Car Loan

● Risk of repossession if loan payments are not made

● Collateral requirement

Pros and Cons of Unsecured Car Loans

Pros of Unsecured Car Loan

● No collateral required

● Can be obtained with a good credit score

● No risk of losing the vehicle

Cons of Unsecured Car Loan

● Higher interest rates

● Stricter eligibility criteria

● Lower loan amounts

How to Apply for a Secured Car Loan?

● Research and compare lenders to find the one offering the best terms.

● Gather the necessary documents, such as proof of income, identification, and vehicle details.

● Fill out the loan application form accurately.

● Provide the required collateral information.

● Submit the application along with the supporting documents.

● Wait for the lender’s approval and review the loan terms and conditions.

● Sign the loan agreement if you are satisfied with the terms.

How to Apply for an Unsecured Car Loan?

To apply for an unsecured car loan, you can follow these steps:

● Compare lenders offerings, interest rates, loan terms, and customer reviews to find the most suitable option for you

● Check your credit score to ensure it meets the lender’s requirements for an unsecured loan

● Gather Required Documents to prove your eligibility and financial stability

● Fill out the loan application form accurately, providing all the requested information

● Submit the completed loan application to avoid any delay in the processing of your application

● Wait for the lender’s approval decision

● Sign to proceed with the loan

Tips for Choosing the Right Car Loan

When selecting a car loan, consider the following tips to help you make an informed decision:

● Assess your financial situation and determine how much you can afford to borrow

● Compare interest rates and loan terms offered by different lenders

● Read customer reviews and consider the reputation of the lenders

● Understand the fine print and ask questions to clarify any doubts

● Seek advice from financial experts if needed

Conclusion

Choosing between a secured car loan and an unsecured car loan requires careful consideration of your financial circumstances and preferences. Secured car loans provide lower interest rates and higher loan amounts but involve the risk of repossession. Unsecured car loans, on the other hand, offer flexibility and no collateral requirement but come with higher interest rates and stricter eligibility criteria. Analyze your needs and financial capabilities to make the right decision for your car purchase.

Droom is an automobile e-commerce platform offering a 21st-century automotive buying experience online with its four value pillars including trust, selection, low price, and convenience second to none. It offers 250k+ vehicles online in 1,100 cities — both used and new. Droom deals in buying and selling cars, 2-wheelers, and other vehicles too. It is an AI and data science-driven platform designed with the best ecosystem tools. Here, we have a team of auto-experts and auto enthusiasts who are dedicated to covering every sphere of the auto industry by simplifying the procedure of buying and selling with Unified Droom Experience. To know more, click here.